Check out our fourth quarter global market review below. Be sure to view the last few pages where we discuss the constant flow of news coming from media and how to tune out the noise!

Check out our fourth quarter global market review below. Be sure to view the last few pages where we discuss the constant flow of news coming from media and how to tune out the noise!

The end of the year is a good time to take stock of the previous 12 months and to position yourself for success for the coming year. Below is a video of how we can help!

"But it’s shaping up to be a “not-so-happy capital gains distribution season”

When an investor sells a stock for more than the purchase price, the investor experiences a capital gain (normal people would call it a profit, but let’s stick to some technical terms for a minute).

For example, if you bought Microsoft at $55/share back in on December 31st of 2015 and sold it for $143/share on October 31st of 2019, the capital gain would be about $88.

Mutual funds operate in much the same way, although it gets a little more complicated. When a mutual fund sells a stock for a profit, it too receives a capital gain and is required by law to pay most of the gain to its shareholders in the form of distributions – after deducting the fund’s operating expenses

2019 – Adding Insult to Injury

Many investors looked the other way in 2016 and 2017 when mutual fund capital gains distributions were announced – after all the markets posted double-digit gains in both years. But then 2018 came and mutual fund shareholders were met with capital gains distributions and losses – adding insult to injury.

The reason in simple terms is because stock markets have been advancing for most of the past 10 years and mutual funds held appreciated assets. In addition, investors keep pulling their money out of actively managed equity funds, forcing portfolio managers to sell appreciated assets, and then those distributions are then passed on to shareholders (and often a smaller group of shareholders too, making the capital gains even bigger).

2019 is shaping up to be much like 2016 and 2017, when capital gains distributions are pretty significant. But the fact that equity markets are enjoying very healthy double-digit returns so far this year alleviates some of the sting.

Look at the Estimates

Mutual fund firms usually begin estimating and publishing their capital gain distributions in the fall and then make final distributions before the end of the year. You should know that mutual funds don’t all make distributions on the same day – they just need to do so before December 31st. And to help you keep track of the distributions and whether they are short- or long-term, mutual funds report this information to shareholders on IRS Form 1099-Div after the end of every year. Here is a something that might have you worried though. A quote from mutual fund watchdog Morningstar’s Christine Benz on November 14, 2019: “Brace yourself: 2019 is apt to be another not-so happy capital gains distribution season, with many growth-oriented mutual funds dishing out sizable payouts.”

Implications for You

It is important to discuss the implications of mutual fund investing and taxes with your financial advisor. Generally speaking, if you own a mutual fund in a taxable account and that mutual fund makes a distribution, you’ll owe taxes on the distributed gain (unless you can sell losing positions to offset the gain). But if you own the same fund in a tax-sheltered account, you don’t have to worry about the distribution until you actually begin selling yourself.

Again, talk to your advisor.

Comparing market returns across the 2000s and 2010s reinforces the benefits of diversification and pursuing known drivers of higher expected returns.

The first decade of the 21st century, and the second one that’s drawing to a close, have reinforced for investors some timeless market lessons: Returns can vary sharply from one period to another. Holding a broadly diversified portfolio can help smooth out the swings. And focusing on known drivers of higher expected returns can increase the potential for long-term success. Having a sound strategy built on those principles—and sticking to it through good times and bad—can be a rewarding investment approach.

Looking at a broad measure of the US stock market, such as the S&P 500, over the past 20 years, you could be forgiven for thinking of Charles Dickens: It was the best of times and the worst of times (see Exhibit 1). For US large cap stocks, the worst came first. The “lost decade” from January 2000 through December 2009 resulted in disappointing returns for many who were invested in the securities in the S&P 500. An index that had averaged more than 10% annualized returns before 2000 instead delivered less-than-average returns from the start of the decade to the end. Annualized returns for the S&P 500 during that market period were −0.95%.

Exhibit 1: S&P 500 (Total Return)

January 2000-June 2019, monthly levels

Yet it was a good decade for investors who diversified their holdings globally beyond US large cap stocks and included other parts of the market with higher expected returns—companies with small market capitalizations or low relative price (value stocks). As Exhibit 2 shows, a range of indices across many other parts of the global market outperformed the S&P 500 during that time span.

Exhibit 2: The 2000s

Annualized returns (%): January 2000—December 2009

The next period of nine-plus years reveals quite a different story. It has looked more like best of times for the S&P 500, as the index, when viewed by total return, has more than tripled since the start of the decade in the bounce-back from the global financial crisis. US large cap growth stocks have been some of the brightest stars during this span. Accordingly, from 2010 through the first half of 2019, many parts of the market that performed well during the previous decade haven’t been able to outperform the S&P 500, as Exhibit 3 displays. Since many of these asset classes haven’t kept pace with the S&P, these returns might cause some to question their allocation to the asset classes that drove positive returns during the 2000s.

Exhibit 3: The 2010s

Annualized returns (%): January 2010—June 2019

It’s been stated many times that investors may want to take a long-term perspective toward investing, and the performance of stock markets since 2000 supports this point of view. Over the past 19½ years (see Exhibit 4), investing outside the US presented investors with opportunities to capture annualized returns that surpassed the S&P 500’s 5.65%, despite periods of underperformance, including the most recent nine-plus years. Cumulative performance from 2000 through June 2019 also reflects the benefits of having a diversified portfolio that targets areas of the market with higher expected returns, such as small and value stocks. And it underscores the principle that longer time frames increase the likelihood of having a good investment experience.

Exhibit 4: 2000—2019

Annualized Returns (%): January 2000—June 2019

No one knows what the next 10 months will bring, much less the next 10 years. But maintaining patience and discipline, through the bad times and the good, puts investors in position to increase the likelihood of long-term success.

APPENDIX: Index Descriptions

Dimensional US Large Cap Value Index is compiled by Dimensional from CRSP and Compustat data. Targets securities of US companies traded on the NYSE, NYSE MKT (formerly AMEX), and Nasdaq Global Market with market capitalizations above the 1,000th-largest company whose relative price is in the bottom 30% of the Dimensional US Large Cap Index after the exclusion of utilities, companies lacking financial data, and companies with negative relative price. The index emphasizes securities with higher profitability, lower relative price, and lower market capitalization. Profitability is measured as operating income before depreciation and amortization minus interest expense scaled by book. Exclusions: non-US companies, REITs, UITs, and investment companies. The index has been retroactively calculated by Dimensional and did not exist prior to March 2007. The calculation methodology for the Dimensional US Large Cap Value Index was amended in January 2014 to include direct profitability as a factor in selecting securities for inclusion in the index. Prior to January 1975: Targets securities of US companies traded on the NYSE, NYSE MKT (formerly AMEX), and Nasdaq Global Market with market capitalizations above the 1,000th-largest company whose relative price is in the bottom 20% of the Dimensional US Large Cap Index after the exclusion of utilities, companies lacking financial data, and companies with negative relative price.

Dimensional US Small Cap Index is compiled by Dimensional from CRSP and Compustat data. Targets securities of US companies traded on the NYSE, NYSE MKT (formerly AMEX), and Nasdaq Global Market whose market capitalization falls in the lowest 8% of the total market capitalization of the eligible market. The index emphasizes companies with higher profitability. Profitability is measured as operating income before depreciation and amortization minus interest expense scaled by book. Exclusions: non-US companies, REITs, UITs, and investment companies. The index has been retroactively calculated by Dimensional and did not exist prior to March 2007. The calculation methodology for the Dimensional US Small Cap Index was amended in January 2014 to include direct profitability as a factor in selecting securities for inclusion in the index. Prior to January 1975: Targets securities of US companies traded on the NYSE, NYSE MKT (formerly AMEX), and Nasdaq Global Market whose market capitalization falls in the lowest 8% of the total market capitalization of the eligible market.

Dimensional International Marketwide Value Index is compiled by Dimensional from Bloomberg securities data. The index consists of companies whose relative price is in the bottom 33% of their country’s companies after the exclusion of utilities and companies with either negative or missing relative price data. The index emphasizes companies with smaller capitalization, lower relative price, and higher profitability. The index also excludes those companies with the lowest profitability and highest relative price within their country’s value universe. Profitability is measured as operating income before depreciation and amortization minus interest expense scaled by book. Exclusions: REITs and investment companies. The index has been retroactively calculated by Dimensional and did not exist prior to April 2008. The calculation methodology for the Dimensional International Marketwide Value Index was amended in January 2014 to include direct profitability as a factor in selecting securities for inclusion in the index.

Dimensional International Small Cap Value Index is defined as companies whose relative price is in the bottom 35% of their country’s respective constituents in the Dimensional International Small Cap Index after the exclusion of utilities and companies with either negative or missing relative price data. The index also excludes those companies with the lowest profitability within their country’s small value universe. Profitability is measured as operating income before depreciation and amortization minus interest expense scaled by book. Exclusions: REITs and investment companies. The index has been retroactively calculated by Dimensional and did not exist prior to April 2008. The calculation methodology for the Dimensional International Small Cap Value Index was amended in January 2014 to include direct profitability as a factor in selecting securities for inclusion in the index. Prior to January 1990: Created by Dimensional, the index includes securities of MSCI EAFE countries in the top 30% of book-to-market by market capitalization conditional on the securities being in the bottom 10% of market capitalization, excluding the bottom 1%. All securities are market capitalization weighted. Each country is capped at 50%; rebalanced semiannually.

Dimensional Emerging Markets Index is compiled by Dimensional from Bloomberg securities data. Market capitalization-weighted index of all securities in the eligible markets. The index has been retroactively calculated by Dimensional and did not exist prior to April 2008. Exclusions: REITs and investment companies.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. Investors should talk to their financial advisor prior to making any investment decision. There is always the risk that an investor may lose money. A long-term investment approach cannot guarantee a profit.

Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss.

All expressions of opinion are subject to change. This information is intended for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services.

Why do most avoid this important investment?

Why do so many of us not use our vacation days? Salespeople talk about “leaving money on the table.” Well, employees leave vacation on the table. And the cost to us is significant. In fact, Americans leave 429 million vacation hours on this proverbial table, according to a report from Forbes. And USA Today reports that, according to their study, over 30% of employees do not use all of their vacation days. When we discuss investing, we talk about putting money aside in order to make a profit. We discuss putting money into stocks, bonds, mutual funds, and so forth. People also discuss investing in your career, like investing in an education or in a certification. Maybe we should talk about another investment that could pay dividends in your career, which is, of course, the place where you make your money. Is investing in vacation a good idea, or just hokey, happy talk?

Reasons That People Skip Vacations

Why do employees avoid vacation? There are several reasons people give for missing out on vacation days:

▪ “I’m afraid that I’ll be fired.” This is the idea that your boss expects constant work and looks down on those “snivelers” who dare to take a break.

▪ “A hard worker should keep his nose to the grindstone and perform.” This is related to the other reasons, and it also involves some allegiance to the idea that hard work is the key, over-arching purpose of life.

▪ “I don’t want my colleague to impress the boss more while I’m away.” People worry about not getting that promotion if they take time away from the office. These reasons are largely self-imposed. As noted below, most managers understand the benefits of vacation to their employees, not only for employee morale but also for his or her performance on the job. Your boss is not Ebenezer Scrooge, despite what you might think.

Study Results

Research studies support the idea of taking your vacations. A University of Pittsburgh study found that leisure activities, including vacations, contributed to less depression and more positive emotions, along with lower blood pressure and smaller waistlines. These results are not surprising, since vacation reduces stress. As reported elsewhere, 80% of workers feel stressed on the job, and 70% of doctor visits are due to stress-related conditions. According to Forbes, not using vacation time is bad for business. Most managers recognize the benefits of taking time off from work because their employees will be more productive, have better workplace morale, and are more likely to stay. Importantly, the health benefits of vacation result in employees missing fewer days for illness and less time for medical appointments.

Benefits

So, based on the studies and the interviews of managers and executives, what are these benefits of taking a vacation? There are, of course, personal benefits to going on vacation or taking a “staycation,” where you stay at home during your time off. You can enjoy your life more and become closer to your partner, your kids, and your friends. You become physically healthier, too. However, taking time off can provide substantial benefits for you in your job or career. To summarize, taking your vacations can:

▪ Reduce stress, which helps in so many ways.

▪ Increase productivity at work, after you return. Taking a break from work and doing what some have called a “digital detox” refreshes you.

▪ Increase creativity, for those times when a better approach or new idea is needed.

▪ Improve your relationships with other workers, so that you’re more positive about projects and less likely to be irritable or say things that you regret later. Of course, things that help you at work also help your company. And many employers know this, from their experience with other workers and managers who take vacations and then perform better. So, vacations are not only beneficial to you, but they also benefit your company.

Conclusion

As one executive put it, according to Forbes, “We seem to be wired to put the pedal to the metal, but there are also undeniable benefits to tapping the breaks.” Using your vacation time, and using it wisely, helps you to become a better employee, which can only help your company. And most managers understand this. Being a better employee will result, naturally, in a higher salary or a better job. Investing in vacation, therefore, is both an investment in your own well-being and in your career and salary. Remember to invest in your vacation, just as you invest in your retirement, your education, or your house.

Now is a good time to check-in and see how you’re really doing

Amid the draining heat of mid-summer, do you remember your New Year’s resolutions regarding your personal financial planning? How are you coming with your to-do list?

Time passes. Our children grow up and we get older. Sand keeps passing through the hourglass of our earthly sojourn. The year 2019 is over half gone. In about a month children will start back to school and traffic will worsen. The summer break for most will be over. So, it’s high time to get done what you need to get done.

As a financial planner, it’s amazing to see the number of number of people with no wills or obsolete wills. Such a lapse in planning is especially critical in a marriage with minor children in the mix. An old will is better than no will, but it carries potential problems for minors, especially if both parents die at once, or a single parent passes on.

Often the bulk of a couple’s savings, or that of a single parent, resides in retirement plans. There too, money passing to a minor presents problems. Have you checked both the primary and contingent beneficiary designations on retirement accounts, and personal and group insurance policies? For those with young children, have you funded a 529 college savings plan for 2019? Anyone, a parent or a grandparent, annually may gift to such a college plan. Gifts are made with after-tax dollars but the money grows tax-free and may be spent tax-free to meet qualified college and graduate school expenses.

How are you coming with plans to pay down debt and build savings outside of your retirement plans? Think about creating a Freedom Fund – a pool of liquid capital equal to at least one-year’s worth of living expenses. Living paycheck to paycheck is motivation- draining stress. Liquid and available capital creates peace of mind and freedom to roll with the punches or pursue opportunities.

If you are a key breadwinner in a family or household, are you adequately insured against the consequences of disability or death? The same question goes for key persons of an enterprise, including business owners.

Is there a succession plan? Is it up to date?

August is half way over. In slightly over three short months, Christmas and holiday decorations will pop up in your local mall.

And if you haven’t made progress on your New Year’s Resolutions, don’t worry – you still have time.

Take, for example, a friend of mine, who was experiencing some troubling medical symptoms. Typing her symptoms into a search engine led to an evening of research and mounting consternation. By the end of the night, the vast quantity of unfiltered information led her to conclude that something was seriously wrong.

One of the key characteristics that distinguishes an expert is their ability to filter information and make increasingly refined distinctions about the situation at hand. For example, you might describe your troubling symptoms to a doctor simply as a pain in the chest, but a trained physician will be able to ask questions and test several hypotheses before reaching the conclusion that rather than having the cardiac arrest you suspected, you have something completely different. While many of us may have the capacity to elevate our understanding to a high level within a chosen field, reaching this point takes time, dedication, and experience.

My friend, having convinced herself that something was seriously wrong, booked an appointment with a physician. The doctor asked several pertinent questions, performed some straightforward tests, and recommended the following treatment plan: reassurance and education. Not surgery. Not drugs. But an understanding of why and how she had experienced her condition. The consultative nature of a relationship with a trusted professional—both when a situation arises and as we progress through life—is one of the key benefits that an expert can provide.

There are striking parallels with the work of a professional financial advisor. The first responsibility of the doctor or advisor is to understand the person they’re serving so that they can fully assess their situation. Once the plan is underway, the role of the professional is to monitor the person’s situation, evaluate if the course of action remains appropriate, and help to maintain the discipline required for the plan to work as intended.

Like my friend’s doctor, advisors may have experienced conversations with clients that are triggered by news reports or informed by unqualified sources. In some cases, all that is required to help put the client’s mind at ease is a reminder to focus on what is in their control as well as providing reassurance and (re)education that they have a financial plan in place that is helping them move toward their objectives. The benefits of working with the right advisor are demonstrated through the ability to both help clients pursue their financial goals and to help them have a positive experience along the way.

Trouble might arise when we confuse simple and complex conditions. Probably no harm is done when a person, recognizing the onset of a common cold, takes cold medicine, drinks plenty of fluids, and rests. But had my self-diagnosing friend not made an appointment with a specialist, and instead moved from self-diagnosis to self-medication, she may have caused herself real harm. Similarly, thinking that all aspects of your own financial situation can be handled through a basic internet search or casual conversation with a friend might result in a less than optimal financial outcome.

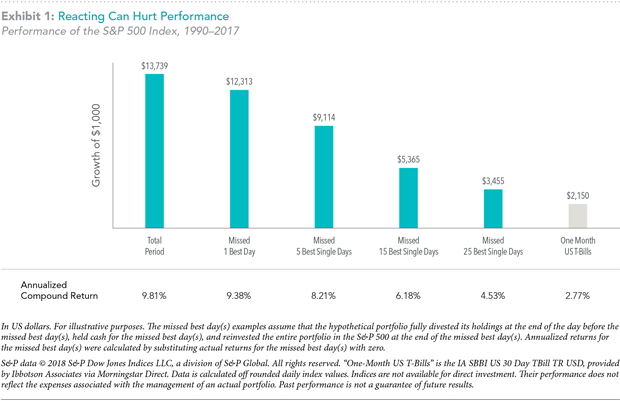

Without the guidance of an advisor, the self-medicating investor might overreact to short-term market volatility by selling some of their investments. In doing so, they risk missing out on some of the best days since there is no reliable way to predict when positive returns in equity markets will occur.1 One might think that missing a few days of strong returns would not make much difference over the long term. But, as illustrated in Exhibit 1, had an investor missed the 25 single best days in the world’s biggest equity market, the US, between 1990 and the end of 2017, their annualized return would have dropped from 9.81% to 4.53%. Such an outcome can have a major impact on an investor’s financial “treatment” plan.

Important Disclosures | Disclosure Brochure | Customer Relationship Summary | Privacy Policy

©2021 Zenith Group.